Financial Professionals

Wealth Advice

Partnership Network

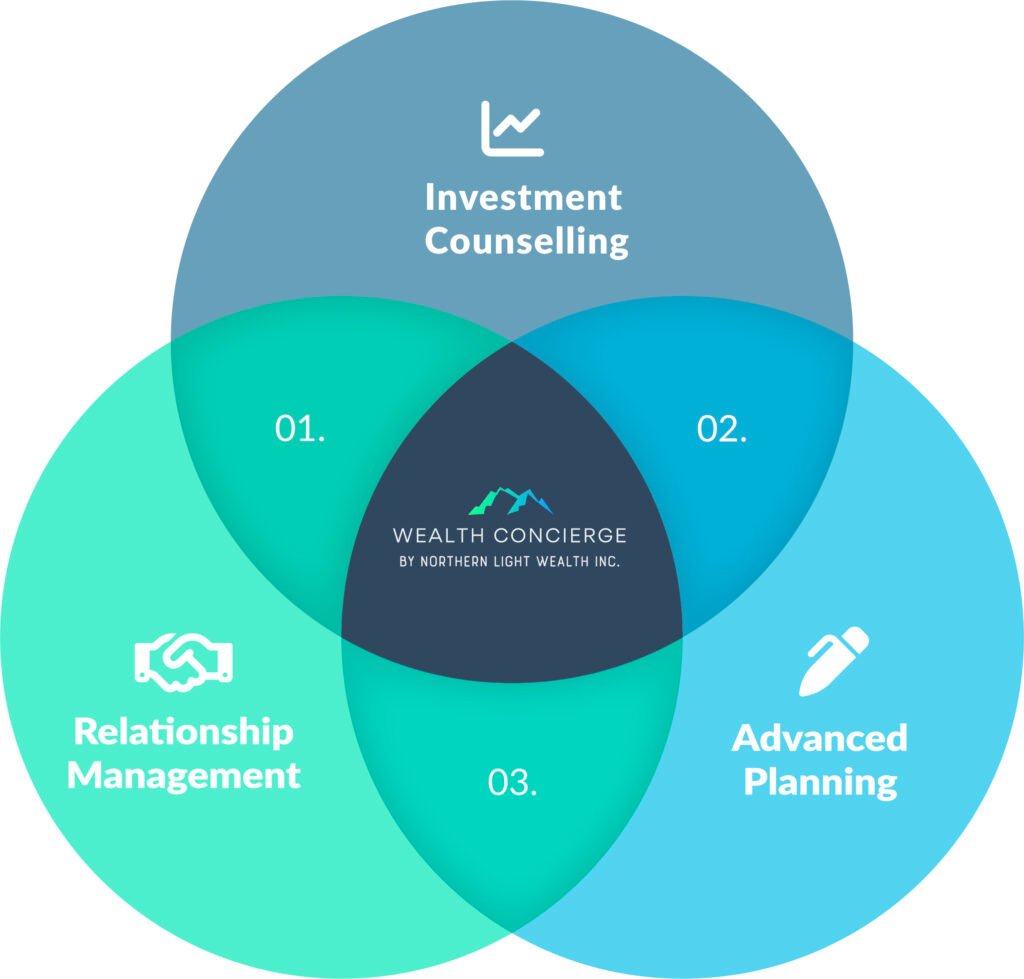

At Northern Light Wealth, we believe that investing is a means to an end, not the goal itself. Our investment consulting approach, a cornerstone of our Wealth Concierge™ process, ensures that every portfolio is designed with intention, precision, and long-term sustainability. By integrating investment strategy with tax planning, estate structuring, and wealth preservation, we align your portfolio with your broader financial vision.

Our investment tenets guide our overall view of growing wealth through astute management of investments over time.

You owe it to your family and yourself to make sure that your investment plan—and overall wealth management plan—is designed to effectively address your very specific financial needs in order to maximize the probability that you will achieve all your financial goals.

We start our relationship with getting to know you, your passions and goals: your purpose. We start with a personal plan so that we know where we are heading and

where you are now. Our comprehensive Purposeful Wealth Journey covers 3 key areas of your life: You, your family, and your legacy.

We know your finances don’t just focus on investments – they’re only a small piece of the pie. It’s rare to find advisers with the expertise required to coordinate with your tax, insurance, financial planning, and debt management professionals to help

align investment and planning strategies.

At Northern Light Wealth, we understand that true wealth management is about more than just numbers—it’s about relationships, coordination, and ensuring that every financial decision aligns with your values and long-term vision. As part of our Wealth Concierge™ process, our relationship management approach enhances collaboration between your accountants, lawyers, and other experts, so that every aspect of your financial world is working in harmony.

We encourage discussions on multi-generational planning, corporate governance or trust structures, and financial education to ensure that your family are well-prepared to inherit not just wealth, but also the responsibility that comes with it.

By acting as the central hub of your financial world, we provide clarity, structure, and guidance, ensuring that your wealth serves both your personal goals and your family’s long-term prosperity.

We follow eight tenets that help to inform all investment decisions for all types of investors.

I. Capital preservation first

Liquidity is key – a return of your money before a return on your money.

V. Guarding Against Trends and Fads

Not all investments are suitable; we prioritize quality, suitability over flashiness.

II. Being Good is Better than Being Lucky

Broadly allocated investing avoids the risks of stock-picking and speculation.

VI. Planning First, Investments Second

Investments are tools to achieve financial goals, guided by robust planning.

III. Emotion is the #1 Danger

Disciplined diversification and clear guidelines mitigate emotional and overconfident decision making.

VII. Modernized Traditional Strategies

We have adapted Modern Portfolio Theory, originally published in 1990, to meet today’s market realities.

IV. Volatility is an opportunity

We can’t predict when markets go down, but we know it will happen. We protect clients during downturns and invest strategically during pullbacks.

VIII. Focus on Efficiency

We emphasize minimizing costs and maintaining low turnover. Where appropriate, we work alongside your tax professionals to help ensure investment strategies are aligned with your broader financial plan.Minimize.